Loss Equivalent Quotient Model Application (LEQ)

- Application

- Risk Management

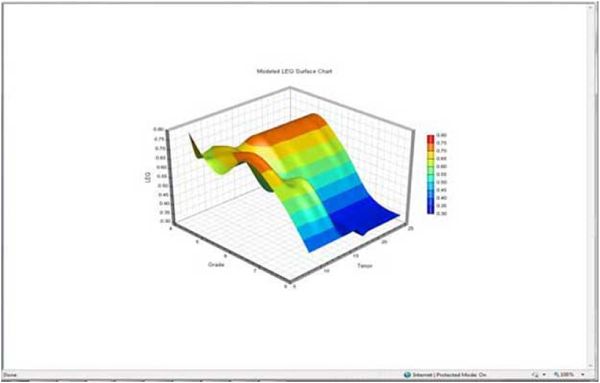

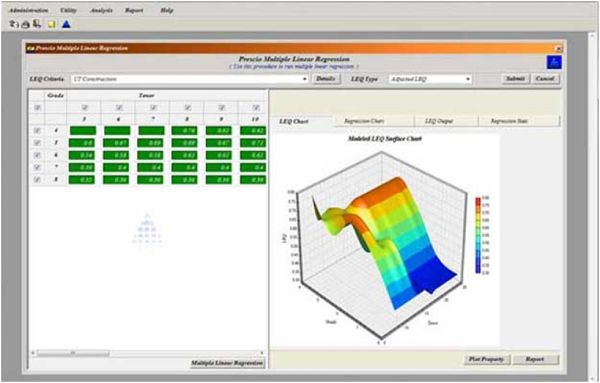

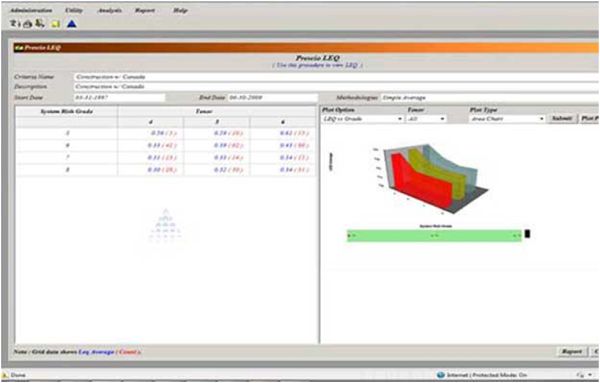

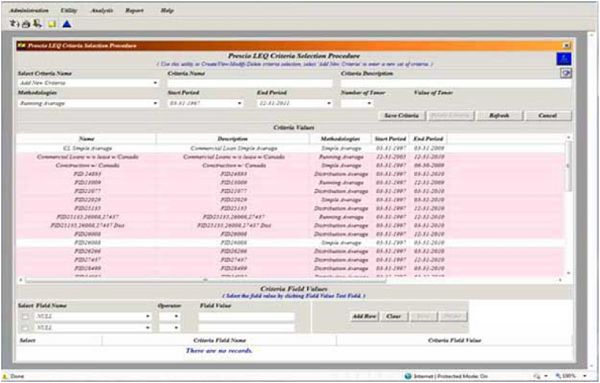

This generalized application allows the user to import raw loan data, clean the data, integrate fragmented or un-fragmented historical loan and disbursement data, and calculate and analyze LEQ data for different portfolios, tenor, risk rating, or PD grade and portfolio scenarios.

Most banks are concerned with credit exposure. This is the additional amount that could be drawn from the unused portion of a commitment. This is characterized by the Loan Equivalent Exposure (LEQ). The LEQ of a credit line is defined as the portion of the undrawn commitment that is likely to be drawn down by the borrower in the event of a default. Prescio developed an LEQ model and an application for commercial loans. The application is a Linux, JBOSS, Oracle, Business Object based N-Tier system.

Because the application has many general functions including portfolio creation capabilities and the ability to integrate fragmented loans and qualitative adjustments, our clients have found this to be a valuable research tool.