Primary Source Breakeven Analysis (PSBE)

- Applications

- Risk Management

This product allows one to determine the relevant information at the point at which the primary source of repayment is reduced until it can just repay the credit facilities (principal and accrued interest) on a 1:1 debt service coverage or breakeven basis due to the emergence of a combination of key credit risks.

This analysis serves three purposes. First, it indicates the strength and resiliency of the primary repayment source by measuring how much room there is for deterioration in key cash flow drivers stemming from key credit risks. Second, it determines the potential reliance on a secondary source of repayment. Third, it identifies the range where terms and conditions should be set (between the base (expected) case and the PSBE). If the transaction has covenants and is structured properly, covenant violations will occur prior to reaching PSBE.

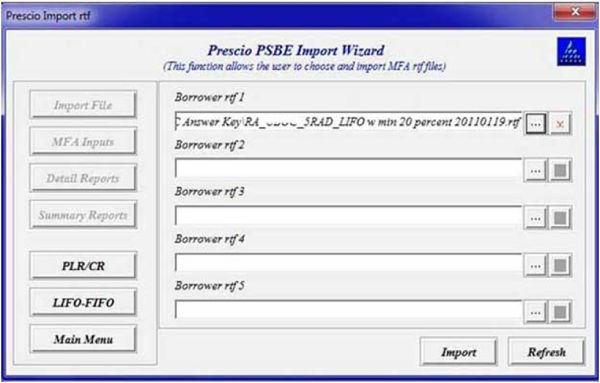

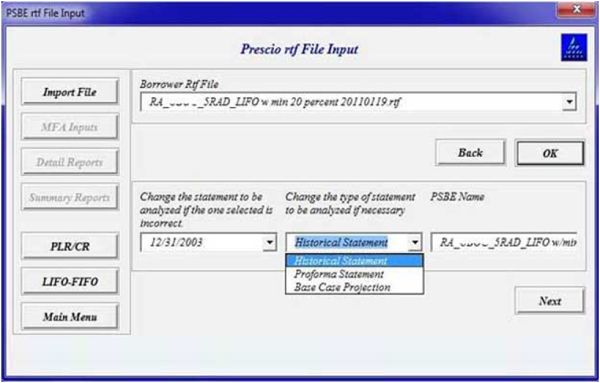

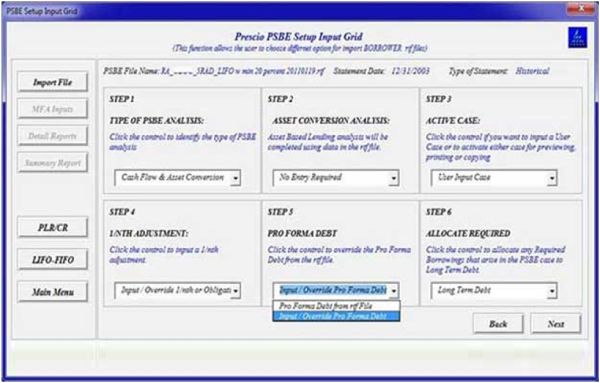

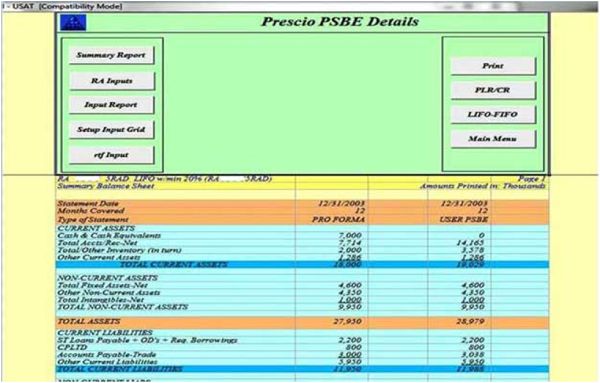

The application allows a user to import rtf files from the Moody’s Risk Analysis system and then allows users to manually input data to determine the PSBE. The output is in the form of an MS Excel spreadsheet or in a Crystal Reports generated document.

The PSBE, Primary Source Breakeven Analysis, is a VBA / MS Excel based product developed for a major US based bank. Prescio also maintains this product on behalf of the client in long-term contractual basis.